Published Thursday Jul 4, 2024: Author Scott Merril: Original Article, Business NH Magazine

For years, people have been warned that only scammers ask for personal banking information via email, and only scammers call to alert you to a security breach and then suggest you move your money to gift cards, or even Bitcoin.

Still, people fall for it. But what happens when the caller is your adult child who was injured in an accident—or is in jail—and needs money wired immediately? This too is a trending scam using generative AI to mimic the voice of a loved one in trouble and preying on emotions to dissuade people from double checking before wiring money.

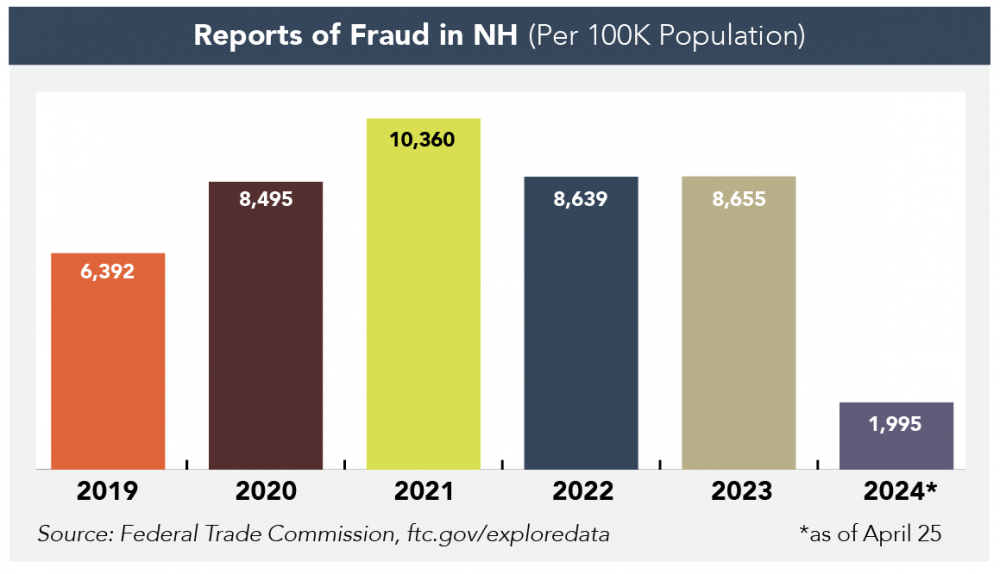

Thousands of Granite Staters fall victim to the insidious traps set by scammers each year. From 2019 until April 2024, fraud of various types accounted for losses of nearly $80 million in NH, according to the Federal Trade Commission (FTC). The most common type of fraud is imposter scams, where the fraudster pretends to be an official and requests information, money, or a gift card to solve the supposed problem. These account for almost half of all Granite State scams.

According to the Federal Trade Commission’s Data Book, people in the U.S. reported losing $10 billion to scams in 2023. That’s $1 billion more than 2022 and the highest ever in losses reported to the FTC, even though the number of fraud reports (2.6 million) was about the same as last year. In NH, there were 8,655 reports of fraud in 2023 and $27.8 million lost. This is up from 8,639 cases and $18.7 million in losses in 2022.

Keeping up with scammers and their schemes requires an analytical mind and constant vigilance, says Diane Porter, senior vice president and director of financial crimes for Bangor Savings Bank. Still, she’d like to think she’s making a difference.

“You have days where you may uncover a fraud but there are other days where you are able to prevent something and it feels like a really big win,” she says. “So, I think it’s just focusing on the trends and doing everything that you can—like ensuring our team is well educated and versed in what’s going on—to protect customers and our communities.”

Porter, who started her career in banking after college, says she is passionate about maintaining the integrity of the financial system. “Even as a front-line associate, I almost took personal offense when someone would victimize one of my customers,” she says. “So, I decided to move to the back end of things to try to make a positive impact and help protect the bank’s customers.”

For the individuals threatened by these scams, people like Porter play a critical role, as the FTC reports that the median loss in a scam is between $200 and $550 per incident.

Trends in Banking Fraud

New Hampshire falls in the top 10 nationally for fraud from imposter scams, online shopping scams and health care scams. In 2023, 3,043 imposter scams were reported by NH residents to the FTC, ranking NH eighth in the country. Fraudsters usually contacted people by email and requested gift cards to address an issue.

Porter says she sees new scams and trends popping up all the time and that “the bad guys will leverage that until technology or education catches up.”

“And then they’re going to move on to the next scam,” Porter says. “We are continually leveraging all of our partnerships to ensure that we are ahead of those [scams] and listening to what’s happening in other markets before it gets here so we’re ready.”

One of the biggest banking fraud trends in the last couple of years has been a type of imposter scam where bad actors call a person and pose as their bank or credit union, says Nicole Huntress, vice president of operations and compliance at HRCU in Rochester.

These scammers sometimes gain people’s trust, Huntress explains, by changing the caller ID on a person’s phone to make it look as though they’re calling directly from the consumer’s banking institution to get their target to divulge their online bank password and ID, or even debit

card number.

“After they’ve gained your trust, the scammer will often tell you that there’s been some fraud in your account and they need to verify your online banking information,” Huntress says. “At that point they can log into that consumer’s digital banking and commit fraud. We’ve seen a really a big uptick in that.”

In cases where a substantial loss occurrs, HRCU engages law enforcement authorities, Huntress says. Between 2021 and 2023, she says HRCU has seen a 186% increase in debit card fraud loss.

Terra Carnrike-Granata, senior director of information security and fraud risk security for NBT Bank, says, “New attack vectors carried out by criminals change almost daily.” While NBT continues to see some of the more traditional scams like counterfeit checks, today’s attacks “are getting craftier and more important for financial institutions to try to stay ahead of,” she adds.

Huntress says consumers are also defrauded by people posing as a law enforcement agency such as the FBI. “Sometimes people are told they have malicious things on their computers and need to pay [the scammer] to get them off of their computer or they could be arrested,” she says. “We’ve seen that one. What they often want the member to do is come in, get a significant amount of money and cash from their account, and then deposit it into a Bitcoin ATM.”

In situations like this, the consumer often takes the financial loss, and Huntress says the credit union turns cases over to the NH Attorney General’s office. “We do sometimes file reports with the government,” she says, adding reports can be filed with the NH Banking Department and the NH Department of Justice as well as the U.S. Department of Justice.

Other times, the scammers pose as actual family members, asking for money to help with an emergency. And you don’t need a large online presence to be a victim. “Now [the scammers] are even using AI to do voiceovers,” says Huntress. “I read something recently where a bad actor only needs between 30 seconds and two minutes of your voice to be able to create a version that can be used fraudulently.”

Fraud Against Elderly Rising

New Hampshire Senior Assistant Attorney General Bryan Townsend heads up the NH Department of Justice Elder Abuse and Financial Exploitation Unit. He says there has been a 71% increase in referrals to the unit over the last five years (from 758 cases to 1,295). The majority of those cases from 2022 to 2023 involved financial harm committed by a trusted person such as a family member or friend. However, reported scams involving people the elderly victim does not know increased from 62 in 2022 to 246 in 2023.

“Scammers will instruct people to produce a wire transfer, a certified bank check or a direct cash pickup,” Townsend says. “We work closely with bank fraud departments and our job is to educate the public about these scams, and to talk to banks, and bank employees, about them.”

Porter says the elderly are often prime targets of fraud because they tend to have more wealth and are often more trusting. “They are a more trusting generation, I think, and they were taught not to be rude,” she says.

Early in the pandemic, the Elder Abuse and Financial Exploitation Unit investigated several romance scams and prosecuted grandparent scams involving a caller pretending to be a relative in distress (often a grandchild) claiming they’d been in a car accident or arrested and requesting money to immediately be sent electronically. With a romance scam, “a particular bank wouldn’t have caught it until someone saw their parent again and asked questions. ‘Why is mom talking about some guy in another country?’” Townsend says. “While scams happen to everyone, one of the biggest issues we’re seeing now involves individuals who are 60 plus.”

The biggest case to date that Townsend’s unit has prosecuted was a grandparent scam that took place between October and November of 2020. Over 10 older adults were targeted throughout NH and seven victims lost $119,000. In December 2022 one person was sentenced to seven and a half to 15 years in NH State Prison. However, that sentence was suspended and the person was placed on probation.

Combating Bank Fraud

Experts in fraud prevention agree that education plays a key role in preventing bank fraud. Townsend says one key to combating fraud starts with making sure bank tellers ask the right questions when people come into a bank asking to withdraw large amounts of money.

“We instruct bank tellers to ask probing questions,” Townsend says. “We want them to get specific about what a customer needs the money for. Even though they [the victim] may be told what to say [by the scammer] that shouldn’t deter the teller from asking questions about anything out of the ordinary.”

Carnrike-Granata of NBT Bank says it is crucial that individuals monitor their accounts, preferably daily. “That’s completely free,” she says. “Gone are the days where we encourage people to wait for their statements to come to them.”

NBT Bank offers its business customers fraud prevention tools like Positive Pay. Banks use Positive Pay to match checks issued by companies with those it presents for payment. Checks that are considered suspicious are sent back to the issuer for examination. “In this way businesses are empowered to review transactions and say ‘nope, I did not issue this check, please return it. It’s fraudulent,” Carnrike-Granata says. Positive Pay also allows companies to protect against unauthorized ACH debits by identifying vendors that are authorized to debit the account with optional dollar thresholds. If an unauthorized ACH debit is presented, the bank notifies the customer so they can authorize or decline the payment.

One sign of progress is the sharing of information between banks concerning fraud. Clearinghouse security groups operating in each state have helped combat fraud, Carnrike-Granata says. “Ten years ago, banks weren’t talking to other banks about fraud that was occurring because they didn’t want to share that information, but now it’s so important that we share what’s happening because there are multiple banks on the street and if [scammers] are targeting one bank, they’re targeting them all.”

Bankers can’t stop every customer from falling for a scam, but they can prevent scammers from accessing bank accounts with account numbers and passwords, even if people provide them. That is because most banks use two-factor authentication, where a code is sent to a phone number before access is allowed. Porter says authenticator apps add another layer of protection.

Changes in Banking

All these changes are making it more difficult to get into somebody’s digital accounts, Huntress says. And this is important, she adds, because “if a bad actor gets into your digital banking, they’re able to send money to other institutions the member doesn’t have any affiliation with. That money is gone.”

To help combat online banking fraud, HRCU has removed multifactor authentication through email. “We found that e-mail is a very common point of compromise where a lot of consumers are being defrauded,” she says. “By making the only option verification through text, we’ve seen a 100% decrease in online account takeover.”

Huntress says HRCU also takes the proactive step of informing its members about fraud. “We send emails with fraud tips for things to be on the lookout for,” she says, explaining that if there is a specific type of fraud happening, immediate notifications are sent. “We really educate the members about coming to us with any questions or concerns that they have. If they’re not confident in who they’re talking to, come into the branch, give us a call, we want to talk to you, we want to talk you through it.”

A NH law passed in 2022 to combat bank fraud allows banks to freeze a person’s assets when fraudulent activity is suspected, and Townsend says this has also been helpful for businesses and consumers to avoid losses.

Huntress says HRCU prides itself on the relationships it creates with its members, and this has been an invaluable line of defense against fraud. “Having those face-to-face conversations and asking people open-ended questions when they come in to do a transaction can save them from losses,” she says. “Developing those deep relationships with the consumers

is crucial.”

Townsend says education is the most important part of his job. “We provide people education on how to protect themselves from these scams because once their money is stolen it’s often gone,” he says. “For me it’s about getting out in community, meeting people and hearing their stories, and stopping crimes before they happen.”