FTC, other government agencies alert consumers to risks of scammers claiming to be from government, demanding money

FOR RELEASE: June 14, 2024, FTC.gov/news-events/news/press-releases

New Federal Trade Commission data reveals that government impersonation scammers are targeting consumers for payments in cash, with the amount of cash reported lost to these scams nearly doubling from 2022 to 2023.

The FTC data shows that consumers reported losing $76 million when paying cash to government impersonation scammers in 2023, up from $40 million in 2022, an increase of 90 percent. In just the first quarter of 2024, consumers have reported losing $20 million to government impersonation scams when paying with cash.

What is the impact?

“The impact of government impersonation scams is massive across the board, costing consumers millions,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection. “For consumers who are convinced by scammers to pay cash, the harms are amplified even further. We’re glad to join with other agencies across the federal government to raise awareness of this issue and work to put a stop to it.”

The median loss for consumers who reported paying cash to government impersonation scammers in the first three months of 2024 was $14,740 – far higher than for any other method of payment. Consumers have reported mailing cash as well as handing cash to drivers sent to collect the money.

It takes a village

The FTC, along with the Department of Justice, Federal Bureau of Investigation, U.S. Postal Inspection Service, Internal Revenue Service, Social Security Administration, Customs and Border Protection, Department of Labor, Securities and Exchange Commission, Department of Health and Human Services, Veterans Administration, Americorps and the Federal Reserve Board, among others, are working to raise awareness of these scams and help consumers understand how they can avoid being drawn into handing over their hard-earned money.

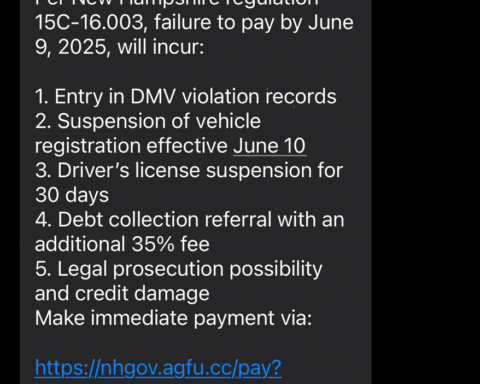

Scammers frequently impersonate government agencies, from local police to federal agencies, and while details of the pitch may vary, a common element is that the consumer they are targeting needs to send or transfer money to address an urgent issue or serious problem. This news is usually accompanied with a combination of dire warnings or threats designed to put their target in a state of mind where the urgency of the moment bypasses any doubts they have.

The key fact is this: government agencies will never call, email, text, or message you on social media to ask for money or personal information, and they will never demand a payment. Only a scammer will do that.

Reported losses to government impersonation scammers across all forms of payment reached $618 million in 2023, up from $497 million in 2022 and $428 million in 2021.

The FTC recently put into effect a new rule that gives the agency stronger tools to combat and deter scammers who impersonate government agencies and businesses, enabling the FTC to file federal court cases seeking to get money back to injured consumers and civil penalties against rule violators.

Consumers who are targeted by a government impersonation scam should report it to the FTC at ReportFraud.ftc.gov. More data about government impersonation scams is available on the FTC’s data dashboards.

The Federal Trade Commission works to promote competition and protect and educate consumers. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Learn more about consumer topics at consumer.ftc.gov, or report fraud, scams, and bad business practices at ReportFraud.ftc.gov. Follow the FTC on social media, read consumer alerts and the business blog, and sign up to get the latest FTC news and alerts.

Contact Information

Media Contact

Jay Mayfield , Office of Public Affairs, 202-326-2656