By LIZ SAUCHELLI | Valley News

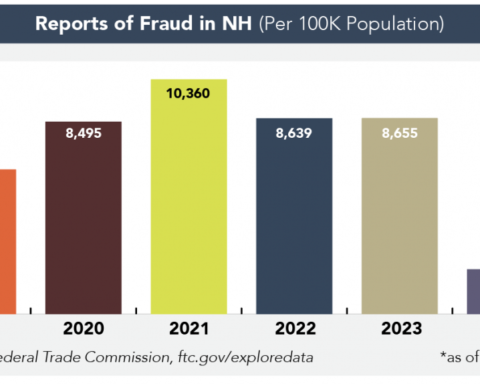

Over the course of five months, Elliott Greenblott tallied more than 220 COVID-19-related scams targeting Twin State residents.

That number likely only scratches the surface.

“Sometimes people will say there is nothing new under the sun; that’s true with scamming as well,” Greenblott, the Vermont coordinator of the AARP Fraud Watch Network, said prior to a virtual presentation hosted by the Dartmouth-Hitchcock Aging Resource Center last Monday. “A lot of scams that I am seeing have to do with home improvement, and the COVID twist is home air purifiers that will get rid of viruses.”

In a sense, scammers are not reinventing anything: They’re using tried-and-true scams while playing on people’s stress surrounding the pandemic.

The “grandparents” scam, for example – where a scammer calls claiming a grandchild is in jail and needs bail money to be released – becomes the grandchild has been arrested because they violated a town’s COVID-19 policies.

Scammers have also found new targets as more people started using technology during the pandemic to stay connected.

“That’s dangerous because the criminals know it as well, and they take advantage of people because of that,” Greenblott said during the presentation.

People have also been home more, meaning they might be more likely to pick up the phone.

“With that as part of the picture, victims become available to the criminal,” he said.

Scams that prey on a pers on’s fear and anxiety – such as promising miracle cures for COVID-19 or testing kits that never materialize – have also started in response to the pandemic.

“COVID is a darn emotional thing, especially if you know someone who has fallen ill or passed away from it,” Greenblott said.

Brandon Garod, a senior assistant attorney general in New Hampshire, said the number of COVID-19-related calls to the state’s Consumer Protection Bureau has declined since the vaccine has become more readily available. There was a spike when the first round of stimulus checks went out last year.

“Scammers definitely took the opportunity to take advantage of that situation,” Garod said.

Once someone loses money in a scam, it can be incredibly difficult to recover – and to track down the scammer. There is a short timetable before someone’s money leaves the U.S. that it can be stopped. Once a money transfer is sent overseas, however, it is effectively gone.

“It’s very challenging to not only hold someone accountable but to figure out who the perpetrator is,” Garod said. Scammers often use fake names, addresses and phone numbers, and they often live outside the U.S.

Scams change with the seasons and currently, there is an uptick in vacation rental ploys. People compile images of real vacation homes on the Seacoast and post them on sites like Craiglist. Then, they use their contact information instead of the actual owner’s.

“Anytime you’re online looking to book things, buy things, you should be extremely skeptical if anyone asks you to wire them money,” Garod said.

There are a few tried-andtrue methods for protecting yourself from scammers. Here are some of them: Don’t answer the phone:

“If you don’t recognize the number that’s calling you on the phone, don’t answer and let it go to voicemail,” Garod said. That goes for numbers with a prefix that’s familiar, as scammers often call from local numbers. “If you don’t pick up the phone, you take away all the power to engage with you in the first place.”

Don’t give out personal information over the phone:

The IRS and other government agencies will not ask you to send a money order or gift card as a payment.

Be wary of the personal information you post on social media: Scammers can use this to better target you.

If you didn’t enter a contest or buy a lottery, you didn’t win: Real contests will not ask you to pay transfer fees to get more money.

Be wary of offers for investments and get-richquick promises: “Anytime you’re given an offer to invest, step back and think about it,” Greenblott said.

Be skeptical: “The old saying ‘If it’s too good to be true it actually is’ applies to scams,” Garod said.