Consumer Financial Protection Bureau

Know your rights

You have rights when it comes to debt collectors.

Ask the caller for their name, company, street address, telephone number, and if your state licenses debt collectors, a professional license number. You can also refuse to discuss any debt until you get a written “validation notice.” Do not give personal or financial information to the caller until you have confirmed it is a legitimate debt collector.

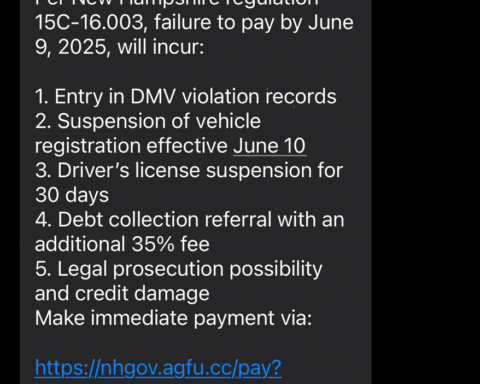

Here are a few warning signs that could signal a debt collection scam:

- The debt collector threatens you with criminal charges. Legitimate debt collectors should not claim that they’ll have you arrested.

- The debt collector refuses to give you information about your debt or is trying to collect a debt you do not recognize. You have certain rights to ask a debt collector about the debt, including when you don’t believe you owe the debt. You can use this sample letter to request more information. Ask for an explanation in writing before you pay.

- The debt collector refuses to give you a mailing address or phone number.

- The debt collector asks you for sensitive personal financial information. You should never provide anyone with your personal financial information unless you are sure they’re legitimate.

If you think that a call may be a scam or a fake debt collector:

Ask the caller for a name, company, street address, telephone number, and professional license number.

Many states require debt collectors to be licensed. Check the information the caller provides you with your state attorney general . Your state regulator may be of assistance if your state licenses debt collectors. If the caller refuses or is unable to provide you with information about the company, or if you can’t verify the information provided, do not give information or money to the caller or company.

Tell the caller that you refuse to discuss any debt until you get a written “validation notice.”

This notice must include:

- The amount of the debt

- The name of the creditor you owe

- A description of certain rights under the federal Fair Debt Collection Practices Act

You can consider sending the collector a letter requesting the information by using one of the CFPB’s sample letters. You can also submit a complaint to the CFPB or you can contact your state Attorney General’s office .

Do not give the caller personal financial or other sensitive information.

Never give out or confirm personal financial or other sensitive information like your bank account, credit card, or Social Security number unless you know the company or person you are talking with is a real debt collector. Scam artists, like fake debt collectors, can use your information to commit identity theft such as:

- Charging your existing credit cards

- Opening new credit card or checking accounts

- Writing fraudulent checks

- Taking out loans in your name

Contact your creditor.

If the debt is legitimate – but you think the collector may not be – contact your creditor about the calls. Share the information you have about the suspicious calls and find out who, if anyone, the creditor has authorized to collect the debt.

Report the call.

Submit a complaint with the CFPB or get in touch with your state Attorney General’s office with information about suspicious callers.

Stop speaking with the caller.

If nothing else works and you believe the calls are fraudulent, send a letter demanding that the caller stop contacting you, and keep a copy for your files.

You can use this sample letter to write a letter demanding the debt collector stop contacting you. By law, debt collectors must stop calling you if you ask them to in writing. However, telling a debt collector to stop contacting you does not make the debt go away and it does not stop a debt collector from reporting the debt to credit reporting companies or suing you.

If you’re having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).